Recap:

In the previous lesson we have learnt about the basic terminology which is used in Finacle. If you have not already read the previous lesson please read it and come back to start reading this lesson.

In this lesson we will learn about the basics of all the transnational procedures. This lesson is very important in this training series. So please pay a bit more attention.

There are two steps in the completion of transaction in Finacle.

Yes there are two steps in the completion of a single transaction in Finacle. In the first step Counter PA does the transaction in his/her login. In the second step Supervisor verifies/authorizes the transaction in their login. This concept of one person doing the transaction and other person verifying is called as maker-checker concept.

Why verification is necessary?

The answer is simple. Verification is necessary to prevent frauds, to check for errors and to prevent any misappropriations.

This verification concept is not new for us. We use to clear forms in the supervisor login of Sanchay post also. But verification had no significance in Sanchay post. Only because we cannot generate LOT without clearing the forms, we used to clear those forms.

But in finacle verification is mandatory. A transaction is completed only after the verification. Without verification of transactions we cannot perform day end operation.

So remember there are two steps in completion of any transaction. The transaction can be cash transaction or non cash transaction; it has to be verified by the supervisor.

Note: There is only one transaction which does not require any verification. It is SB withdrawal up to Rs.5000/-

The Four states of a Transaction

In the above section we have learnt that a transaction is not completed until verification is completed. So before verification a transaction will be in unverified state. In this unverified state there are 2 stages/states.

They are

They are

1. Entered State

2. Posted State

After counter PA does a transaction in Finacle, it can be in either Entered state or in Posted State. After verification, the transaction changes its state to Verified State.

So totally there are 3 states for a transaction.

1. Entered State

2. Posted State

3. Verified State

Now let us see what is meant by Entered state, posted state and verified State.

1. Entered State: If a transaction is in entered state, it means that the deposit or withdrawal relating to that transaction has not yet been affected in the ledger of the account.

It means that, the transaction takes place but it will not affect any of the ledgers, be it the account ledger, teller cash position or LOT. Only after verification all these will be affected and the transaction will change its state to Verified State.

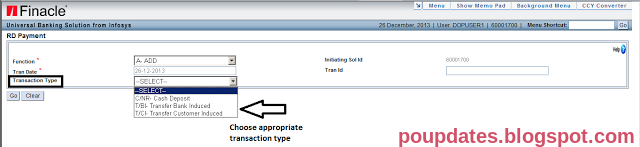

The transaction which will be in entered state before verification are a) RD deposit, b) SB withdrawal above 5000 and c) New accounts in which transaction is required.

We cannot modify any transaction once it is done.

We can delete transactions which are entered state. So if you do any mistake in transactions which are in entered state, we can delete that transaction and do that transaction again correctly.

Deleting does not mean that the transaction completely vanishes from the system. It will be available in the system as a deleted transaction.

2. Posted State: If a transaction is in posted state, it means that the deposit or withdrawal relating to that transaction has affected the ledger of the account.

It means that, the transaction has affected the account ledger, teller cash position and it will also appear in the LOT.

The transactions which will be in posted state before verification are a) All transactions which are not in entered state b) all transactions which are not in verified state and c) transaction whose state is modified from entered state using HTM menu before verification.

We cannot modify or delete a transaction which is in posted state.

3. Verified State: A transaction is said to be verified only after verification is done by supervisor. But there is one exception. SB withdrawal up to Rs.5000/- does not require verification. It will be in verified state by default.

We cannot modify or delete a transaction which is in verified state.

4. All transactions which are deleted will be in deleted state. Only the state changes from entered to deleted state. The transaction will still be available in the system for inquiry.

So these are the four states of transaction. I hope you are following me.

Since this is not a live training session. I will give you some work which you have to do in office. From this lesson onwards you will have some observations to do in the office. If you do these observations or work which I give you at the end of each lesson from now onwards, you will understand more clearly what I’m trying to teach.

1. Collect some SB, RD, PPF and SSA transactions which you have done in the day.

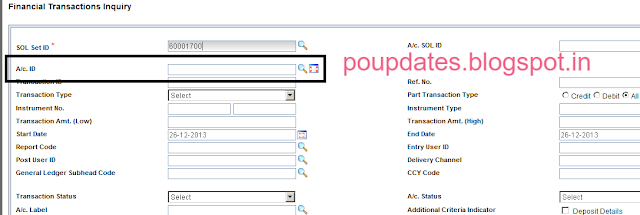

2. Invoke the menu HFTI (Don’t worry I’ll teach about HFTI menu in detail in later lessons).

In the A/c Id field enter the account numbers which you have collected in the first step, one by one. For example, enter SB account number of the transaction and Click on Go button.

5. Repeat the same process with the vouchers of all transactions.

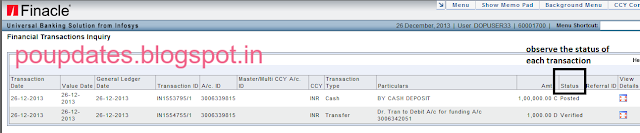

What you have to do is observe the status of each transaction before verification and after verification.

So that’s it for today’s lesson. See you again tomorrow.

1. There are two steps in completion of a transaction. Counter PA does the transaction and supervisor verifies the transaction

2. There are three states for a transaction. They are Entered State, Posted State and Verified state.